FileYourTaxes is a website which lets you file tax online for free if you qualify the eligibility criteria given on the website. This website is also a part of the IRS free file alliance. Hence, you ca trust this website with your information. For free federal return your AGI (adjusted gross income) should be between $9,000 to $66,000 or if you are a active duty military personnel then you qualify.

As for state tax returns, only people with earning in 4 states (IA, ID, ND, & VT) can file a free state return. People living or with earnings in other states can file a state tax return at a nominal cost.

Earlier we have covered some tax websites which also offer you free tax filing with some eligibility conditions. These websites are 1040.com, H&R Block, TaxSlayer, TurboTax, TaxAct, 1040NOW.NET, ezTaxReturn, FreeTaxUSA, and Online Taxes at OLT.com. You can also check out any of these websites for your tax filing needs.

Go to the home page of the FileYourTaxes website, the link for the website can be found at the end of this article. The home page of the website will look like the screenshot below. Towards the right side of the page you can see the qualifying criteria for a free tax return. Click on see if you qualify button.

You will be asked a couple of questions, if you answer yes to any of them, then you are eligible for a free return. Click on the let’s get started button. To start with filing, you need to create an account with the website. Provide your email address, name, username, password, social security number, phone number, and then add some security questions, in case you forget your password.

Once you are logged in click on the begin a new return link. You will be asked to fill in your address and then you will move on to the filling status page. Choose a filing status and move on to the next page. On this page you will be asked some questions and at the bottom of the page you will be asked to enter a license or state identification number.

Then a verification email is sent to you and you have to enter a code from it here.

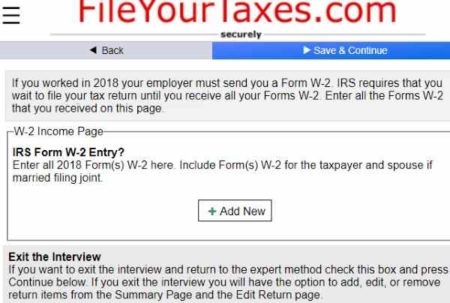

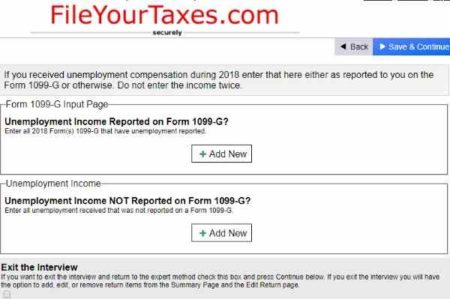

Then we come to the income section where you can add your W-2 information. Enter your EIN, employer address, wages, tax withheld, etc. Next you move on to other income categories like interest income, dividend income, unemployment compensation, business income, distributions from a IRA, etc.

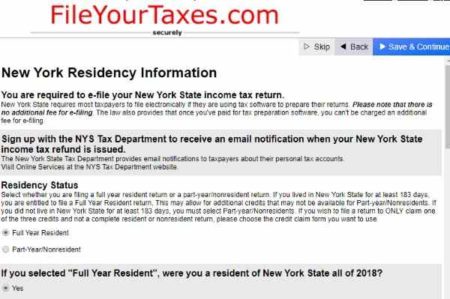

You will also be asked about the earned income credit to see if you qualify for it. Then you move on to answering some questions about your health insurance coverage for the year. After this section you will be asked some state residency questions. Go ahead and answer accordingly.

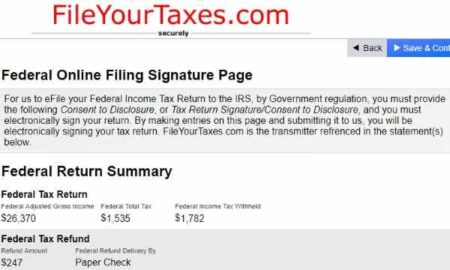

Now you will be shown a summary of both your federal as well as state tax returns. Click on the I’m done with my return button given on top of the page to continue.

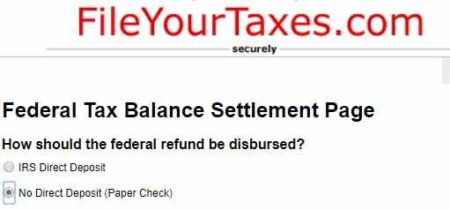

Then you will be asked to choose how you would like to get your tax refund back. You have two options, the refund can be directly deposited in a bank account, or you can get a paper check mailed to your address. Choose accordingly and continue.

Then for efiling your return you need to enter a 5 digit pin number that you choose. This pin number will be used as your digital signature while efiling the return. Do note down your pin number as it will be helpful next year when you file your return as well.

You will now be shown if you qualify for the free filing option or not. In the example we are working on, the federal return qualifies for free filing but the state return is a paid return. This can be seen in the screenshot below.

Now your return is ready to be efiled. You can pay for the state return and file your federal return for free online.

Conclusion:

FileYourTaxes is a nice website to file your tax return online. It would even be great if you qualify for the free file option. The website does look a bit complicated with how questions are asked. There is a lot of text, that you have to go through, which makes the whole page look complicated and something you would refrain from doing. The layout could have been more user friendly, by maybe asking one question per page, and the text being spread out instead of a lot of text on one page. Apart from this, I think the website is good to file your tax return for free if you meet the eligibility criteria mentioned on the website.

Check out FileYourTaxes website here.