Indzara’s Personal Finance Manager is an Excel based tool for the management of personal finances. This personal finance manager is a simple & easy to use tool for managing and tracking your day-to-day expenses, your income, your credit card bills, utility bills etc. You just need to provide a few basic details like where all do you spend your money, your monthly salary, your debit account details, credit details, etc. and this tool will do all the calculations for you.

A finance management tool has become a necessity these days as it can help you to take better financial decisions, while taking into account various factors that affects your finances. These days we all have multiple bank accounts, credit cards, debit cards, we pay our bills through cheques, make online transactions, withdraw money from ATM’s, and the list goes on.

This way you can keep a tab on all your money matters. It is a very handy tool in the form of a simple excel template that makes it easy for you to know your financial condition. This is so because, it presents all the data that you will enter in a more understandable format using Graphs, pie charts etc., which can answer major questions about your personal finances.

Personal Finance Manager by Indzara has three worksheets, namely, Settings, Transactions, and Report.

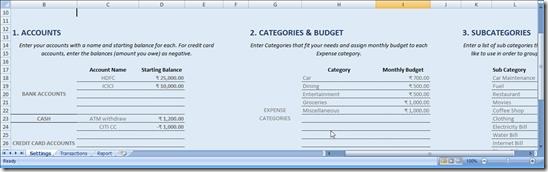

Settings Tab:

You have to provide your income details on the first tab i.e. Settings Tab of the excel sheet. Also, mention your budget categories, Income categories, and transfer categories. Usually these are the three broad categories we get all our money from or spend all our money on. You can also specify Sub Expense categories. For example., Phone Bill can have two sub categories, Mobile bill and Land-line Bill. So you can make your own categories depending on how you spend money and earn money.

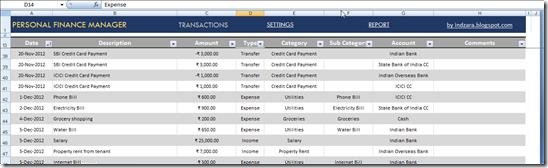

Transaction Tab:

After providing the necessary information of Settings tab, you can come to Transaction tab. In this tab you need to mention all the transactions that you do. This includes your income, Expenses, and the Transfers that you make. You just need to fill the date of transaction, a short description, amount, type, Category, sub category, account, and comments, if any.

Type of transaction has three options, Income, Expense, and Transfer. Income is from where you are getting the money from. Expenses are the money that you spend. Transfers are the transactions that you make, this includes, Credit card payment, transfer money from one account to another, ATM money withdrawal etc..

Categories and Sub categories are the ones that you have specified on Settings tab.

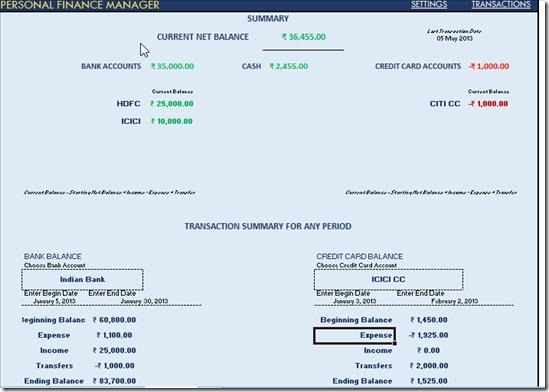

Result Tab:

The Third tab is Result Tab. This is where you can see the entire report of your finances based on the data that you have entered. Information related to exceeding the budget or net balance or expense trend can be obtained from this tab. Data is presented in the form of tables, charts, and Graphs. So you just refresh the data by doing a refresh all, as shown below.

Now the report tab will show four types of reports. The first one will give you summary of your expenses and income, your account’s beginning and closing balance and Credit card balance. You can go through the screenshot below.

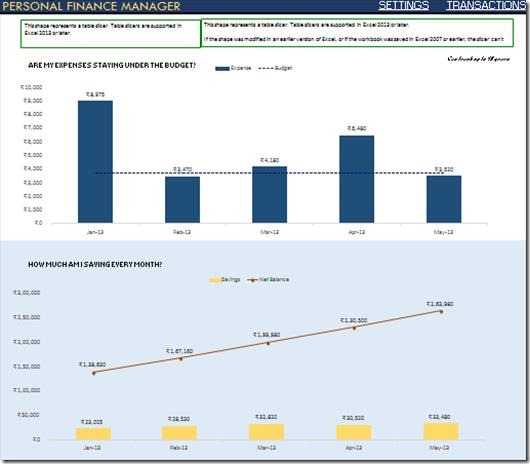

The next report will give you summary for a particular month. For Income and Expense, it will show you in the form of pie charts, Budget – Expenses in tabular format, and Expenses by sub categories in the form of a graph as shown in the below screenshot.

Third and fourth report will tell you about your savings and your spending on sub-categories respectively.

Overall Review

Indzara’s Personal Finance Manager is a nice and handy excel application. It is fairly easy to use and lets you choose spending and income categories. Personal Finance Manager is a necessity if you are unable to manage your money matters and end up thinking where has all your money gone. Indzara’s Personal Finance Manager takes care of all that, hence is an application worth trying. It is free and you can get it from here.