MoneyControl is a free expense tracker app for iPhone and iPad to record all expenses and incomes. This iPhone income and expense tracker app gives you a clear picture of all your transaction of incomes and expenses on daily basis.

Note: The free version of the app allows you to manage up to maximum of 20 expenses and income entries per month. This limitation can be removed by upgrading to premium version for $1.99.

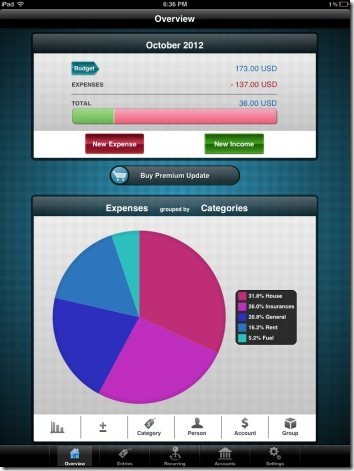

At the month end, you can easily check out the key areas where you can improve and manage your expenses in an efficient way. The app calculates the total of all the expenses which you made. Then the app itself calculates the difference in total expenses and incomes which you have recorded. With this you can know if your expenses are in tune with your income or not.

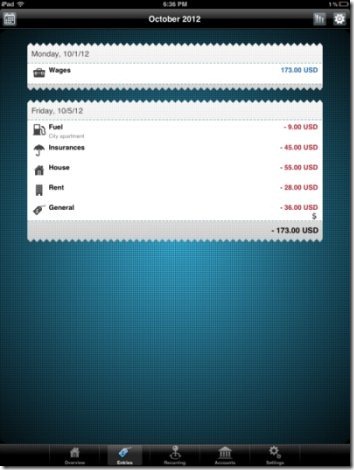

MoneyControl is one of the easiest app to create new entries for all your daily income and expenses. While recording the expense transaction, the app provides a specific category to select and record the expense accordingly. Category separates all the expense entries and makes it easy for you to identify any expense for the list of expenses. It becomes even easier when you browse expense list by looking at the category icons which you have selected. On top of it, this iPhone expense tracker app prepares a bar graph which shows the total income and expenses according to the category selected.

For each expense entry which you make can be shown under a specific category; as I already mentioned above, account, person, and group. Advance categorizing of expenses, even makes it easier to identify any specific expense when you have a bundled list of expenses recorded on your iPhone.

The only thing which I was missing in the app was it budgeting section. The app does not allow you to prepare a budget for every month. Budgeting gives you a clear picture of extra spending than the expected. But it is ok for me to use this iPhone expense tracker app without preparing a fair budget on my iPhone.

Check out other expense tracker apps for iPhone.

Why You Should Use This iPhone Expense Tracker App?

Now you might have a clear image about MoneyControl app for iPhone. If you are really excited to record each day’s expense and income entries, then this app might end your search on your iPhone. Also, if you want to see the progress in the fair management of your income and expenses, then this app can help you in a better way as it prepares a nice bar graph for all your expenses and incomes.

How To Use MoneyControl App On iPhone?

Once you complete the installation of the app, just launch it and get started. Tap on new income button and select the date. Now tap on new expenses button and start recording your daily expenses. While recording all your expenses, remember to put it in the right category. At the end of the month, just check the overview of all your incomes and expenses which you have recorded.

Features Of MoneyControl App:

- Record all your expenses and incomes.

- Automatic calculation of total of all the incomes and expenses and calculation of difference in incomes and expenses.

- Prepares a fair bar graph showing the total income and expense.

- All the expenses and incomes are identified via category.

- Categories are identified through icons which makes it even easier to identify any expense from the long list.

- The app is protected with a passcode so as to make your budget information confidential.

- Ads free app in Apple App Store.

- Prepares a pie chart showing the expenses in the form of percentage.

- You can change currency and add a new category.

- Export the data in CSV file format.

- Backup and restore all your data.

- Supports both iPhone and iPad.

For Android users, check out expense manager apps for Android reviewed by us.

Install MoneyControl App:

Login to the App Store and search for “MoneyControl – Income And Expense Tracker” app. You can even click here to download and install MoneyControl app. If you want to get the direct download link, then scan the QR Code below.

Conclusion:

MoneyControl makes your money management easier and faster. You can easily increase your savings by saving few bucks through efficient management of all your expenses and incomes. However, the limitation of just 20 transactions per month might make this unusable for most of the users out there.