Update 2022: This website no longer exists now. We recommend you to try some other alternative instead.

PlanWise is a free online personal finance management service where you can easily plan your long-term income and expenses, set goals and financial plans when you’re interested in buying a new home, apartment, car or anything else that’s a bit more pricier and requires you to strategies your finance. With PlanWise you can manage your money so that you make better use of it, not just be a spendthrift.

Similar software: Personal Finances, LedgerSMB, SQL Ledger.

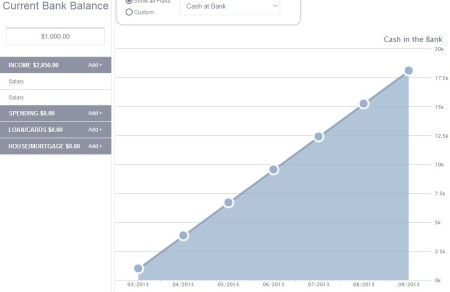

Interface of this free online financial planner can be seen on the image above. To test the features of PlanWise you don’t even have to register, but in order to save data account has to be created. One of the things that you’ll notice right away is the large chart which takes up better part of the area in the bottom right corner. That’s where income projections are gonna be shown, based on the income and expenses that you setup. Left sidebar holds two most important options that you’ll need, current finances management and plan management. Key feature of PlanWise – free personal finance planning service are:

- Introduction tour – helps and explains the basics of PlanWise

- Current finance management – keep track of income and spending

- Future balance projections – based on info from the current info

- Manage and keep track of your credit cards, loan and mortgage spending

- Planning – financial planner for when you wanna buy a car, house, etc.

- Free and very simple to use – web based service – web browser access

Saving money for buying things that we need, that are more expensive is never an easy thing to do. There’s always something that we come across that we absolutely have to have. Whether it’s some technological gizmo, like a new smartphone model, new cloths, something always seems to eat up our savings. Setting up a financial plan and savings strategy might help out with that. Here’s a few pointers to help you do that with PlanWise.

How to manage personal finance with PlanWise

First thing which you should do is click on the Current Finances button from the left sidebar and there add all the income and all the expenses that you usually have during the month.

As you are typing in numbers the chart on the right is going to change projections. These are yearly projections, and they’ll change depending on what kind of income and expenses you have.

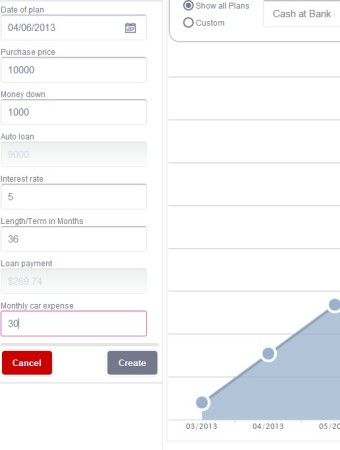

To create a plan, click on the Add Plan button, and select one from the plan presets, dozens are available. We decided to buy a new car. Fill out all the info, car price, down payment, interest of the loan and when you’re done, you’ll be presented with a new projection chart where your financial plan has been taken into account.

Conclusion

If you are having problems managing your money and planning for the future, you should definitely give PlanWise a try. It offers a very large number of plan presets, buying a car, house, there’s even a financial plan for when you lose a job. It’s web based, and you don’t even have to register to give it a try. Free service.