The blog-post details 5 best expense manager software for Windows 10. Efficient and proper management of expenses is key for keeping control over finances, and this is true for not just organizations and businesses, but also households. That’s why a solid expense manager application is something you must have on your PC.

And guess what, those are the applications that this write-up is all about. These expense manager applications make you track personal and organizational finances better, and include features like checkbook style registers, multiple account management, and the ability to view financial data graphically. Sounds like loads of fun? Let’s jump right in, and find out more about 5 best expense manager software for Windows 10.

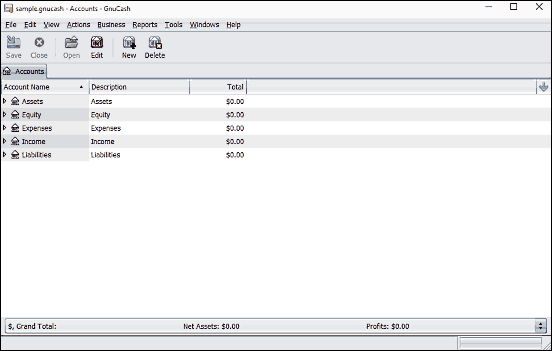

GnuCash

One of the most powerful accounting software out there, GnuCash is chock full of more goodies than you’ll probably ever use. Although it can be used to manage personal finances just as easily, the versatile feature set of GnuCash makes it much more suited towards the needs of small businesses. This thing not only lets you income and expenses, but also a variety of bank accounts and even stocks. Because of the sheer number of features it comes with, GnuCash can look intimidating at first, but becomes quite easy once you get a hang of it. You can use it for double entry accounting, small business accounting, as well as for the management of stocks, bonds, and mutual funds. The checkbook style register provides a convenient way of entering transactions, which can split, and scheduled. Then there’s the ability to view financial data visually as bar charts, pie charts, and scatter plots. And that’s just the tip of the iceberg. GnuCash has experimental database support, repayment assistant, account reconciliation features, and a lot more. Click here to find out more.

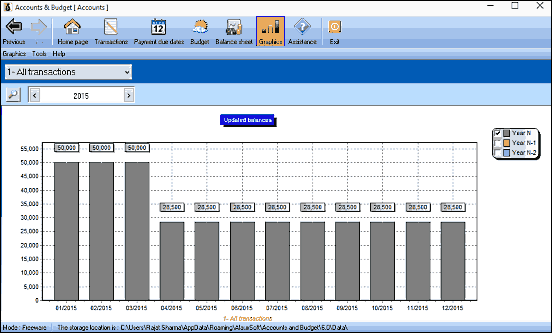

Accounts & Budget

Feature laden yet easy to use, Accounts & Budget is a powerhouse application that can take care of all your expense management needs. Whether you want to take care of domestic expenses, or the finances of a small organization, Accounts & Budget is there to help. The application is easy to use, and you can lets you define a monthly budget to be worked upon. Once that’s done, you can add credit/debit transactions of a diverse variety, such as salary, bills etc., and populate them with additional information like payer/payee, mode of payment, and more. There are quite a number of predefined categories, though you can always add custom categories of your own. Accounts & Budget also lets you view monthly reports in the form of pie charts and bar graphs, and you can even export the data in popular formats like CSV and HTML. Find out more here.

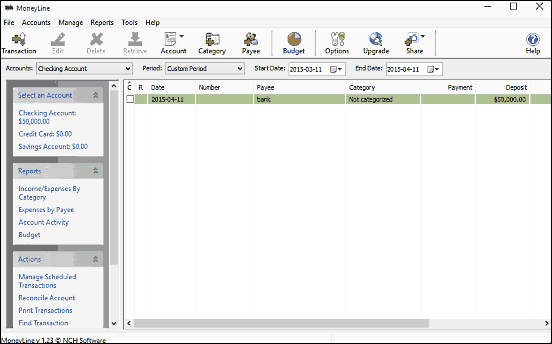

MoneyLine

Free applications don’t have to be restricted when it comes to features, MoneyLine is the perfect example of that. The featherlight gratis program comes with a whole slew of tools for effortless personal accounting. This is achieved by means of a checkbook register, which can be used for all kinds of personal accounts, such as savings and checking accounts. You can add multiple accounts, and things like credit cards, bank details etc. to them. Not only that, MoneyLine also lets you categorize transaction types and set budget limits to better manage finances. Transactions can be split across categories, and you can also schedule recurring transactions. Heck, there’s even a budgeting wizard. Read more here.

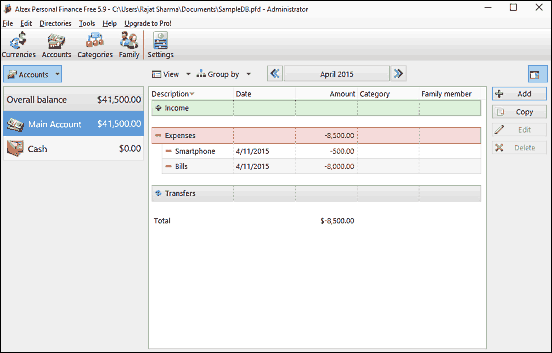

Alzex Personal Finance Free

If you’re looking for a robust program to take care of your personal expenses, look no further than Alzex Personal Finance Free. The freeware application has a pretty slick looking UI, and includes a ton of features for effortlessly managing finances. Alzex Personal Finance Free essentially works by grouping expenses and income into separate categories, which can be managed individually. You can add a number of transactions to these categories, and add details like category, identifier icon, additional comments, and much more. Expenses can be grouped by multiple parameters, and special tags can be assigned to them for better management. Alzex Personal Finances Free supports nearly all major world currencies, and even precious metals.

FreeMoneyGuard

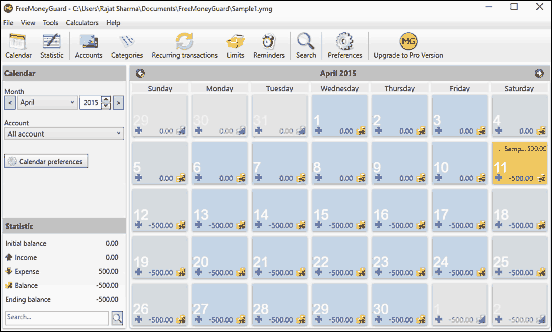

Although its user interface takes a while getting used to, FreeMoneyGuard is actually quite a simple program for managing expenses. The highlight feature is the default calendar view, which makes monthly expense management a walk in the park. All you have to do is click on the little plus sign below a date card, and a pop-up window will come up, where you can add the details of the credit/debit transactions of the day. For each of the transactions, FreeMoneyGuard lets you add a variety of information such as description, category, associated account, and of course, amount. Apart from that, you can also add notes and even reminders. What’s more, you can add and manage multiple accounts, impose limits, configure recurring transactions (e.g. rent), and even view basic reports.

Conclusion

The above discussed applications are perfect for efficient tracking and management of both personal and organizational finances. Try them out, and let me know your thoughts in the comments below.