In this article, you will read about a Loan Simulator by the Department of Education to plan student Loan Strategy.

Education being one of the basic foundations of support of an individual, has been a costly endeavor for most people in the US. To complete the higher level of studies, most people turn towards the student’s loan.

While most of the students are looking forward to completing their education, many people only have a blur idea of the strategy to repay their student debt. In the U.S., student debt is astounding. While you can visit the bank and use various conventional ways to calculate your debt, you can use this web application to make your student loan decisions easier over the course of time.

Loan Simulator by Department of Education To Plan Student Loan Strategy

Loan Simulator is a simple web platform by the Department of Education on the website of Studentaid.gov, which helps you find various strategies regarding the student loan. Through a series of questions, this website builds your results based on your needs and career goals.

Visit the website studentaid.gov, and there you can find the option of Loan Simulator on the website under the Manage Loan section. Alternatively, you can simply click here to visit the website.

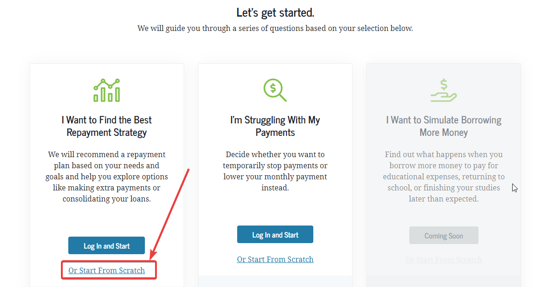

On the redirected page, you find two options to choose from, while the third one is still in progress. For starting, I’ve chosen “start from scratch” below the option “Find the best Repayment Strategy”. Then you will go through a set of 3 questions that will be redirected towards your career goals, financial strategy, and various other choices.

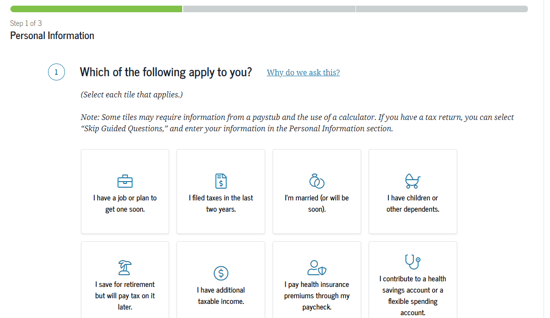

Several questions asked may include your personal information, loan repayment goals, and loan information.

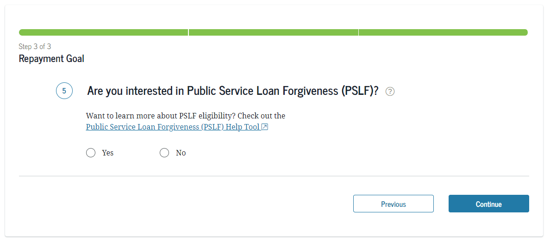

You will also find that this Loan Simulator consider your career choices (Public or Private) to further strategize your Loan repayment strategy.

Although this website helps you determine the best loan repayment strategy, it is required to be kept in mind that this strategy is based solely on the information you provide. It is to be considered keenly that every student loan is unique and will require its own in-depth study. Loan Simulator does not provide any financial advice on any type of student loan. However, it can help you access your student loan situation a bit clearly.

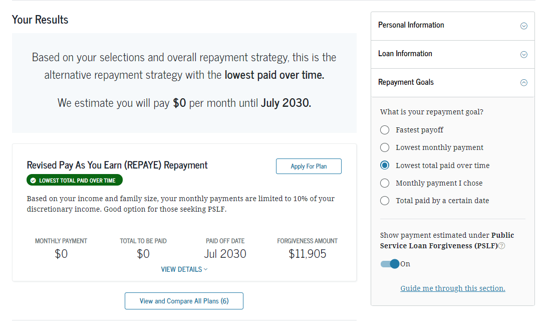

In the result page, you can see all your answers to the previously asked questions on the right-side panel by clicking on the down arrow.

The result will show you the monthly payment, with the “Paid off Date” as the alternative repayment strategy. If you click on “View Details”, you will be able to see all the advantages and disadvantages of the plan.

In brief

This online loan simulator platform can be a great start to plan your student loan repayment strategy. This is a reliable platform as it is started by the department of education itself.