Bonsai offers a free online self employment tax calculator. If you are self employed/freelancer and worry about taxes then this website will help you a lot. The website will give you an estimate about whether you will owe taxes or will be getting a refund. All you need to do is enter some basic information on this website.

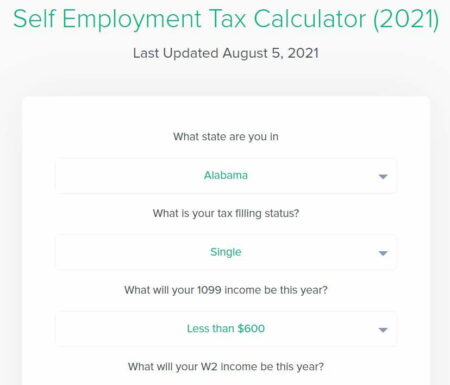

The website has a simple interface, you can see that in the below screenshot. Just click on the self employment tax calculator tab and the calculator will appear on screen.

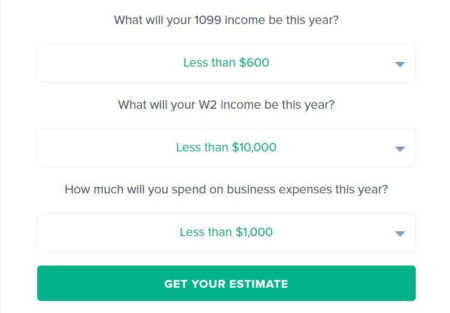

The calculator will ask you to answer some basic questions like the state you live in, your filling status, income from W2 & 1099 forms, and expenses you incurred in your business for the year.

After filling out this information just click on the “Get your estimate” button given below.

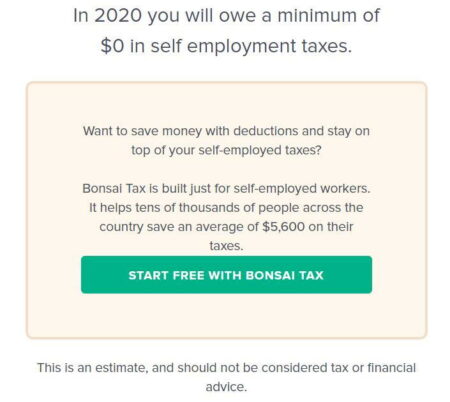

After a few seconds your estimate will appear on your screen. This estimate will show you whether you will owe taxes or you will be getting a refund.

As this is just a estimate based on minimum information, if you want you can sign up with the website for a more detailed tax estimate.

The website also offers you a free tax guide eBook which will help you get to know more about deductions you are eligible for as a freelancer.

You can download this eBook by entering your email ID in the given box and clicking the download button.

Summary:

Being self employed and not having to worry about taxes is a big deal. If you can easily get information on what deductions you are eligible for, and if you owe taxes for the year, than it would be great information to have. The self employment tax calculator will give you a fair idea if you will owe taxes or not. Based on that information you can plan your financials. You can also get more guidance about taxes and deductions with the help of the eBook which you can download.

Check out this free online self employment tax calculator here.