This article covers 5 free salary calculator websites with State tax calculations. These websites let you calculate hourly, weekly, bi-weekly, monthly, and yearly salary. Along with salary they also calculate taxes like federal tax, state tax, city tax, etc. After deducting all these taxes you are shown your take away salary. All these websites have different features in them and some have a simpler layout while some may look a little complicated.

But all these websites let you calculate salary by just entering your gross yearly pay. Some websites might ask for additional details like filling status, number of dependents, etc. Let’s look at these free salary calculator websites with state tax calculations below.

Calculator.net

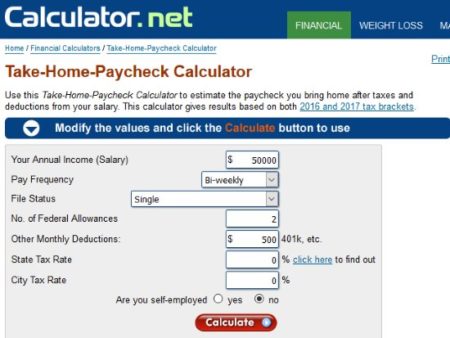

Calculator.net is a free website which lets you calculate your take away salary after all the taxes have been deducted from it. When you land on the website you will see a calculator like the one shown in the screenshot above. In here you have to enter your annual income in the first box, then select how frequently you are paid like weekly, bi-weekly, monthly, etc., then choose your filing status, and any deductions you claim. After that enter the percentage of state tax that you pay and percentage of city tax that you pay. State and city tax you will need to enter manually as per the state and city tax limit of the place you stay in. In case you do not know this percentage, you can easily find it out online. Check the check box if you are self employed. After filling these fields in click the calculate button to calculate your take home salary.

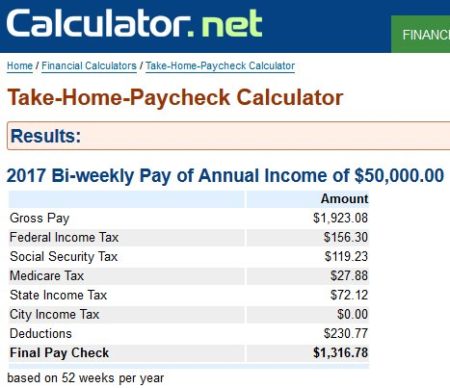

A screenshot like the one given above will be generated. In here you can see you are shown the gross pay at the top, after that the federal taxes which will be cut out of your gross pay will be mentioned. The social security taxes, medicare taxes, state income tax cut out of your gross pay are mentioned. After all deductions the final pay check which you receive will be mentioned. So now you can easily find out how much salary you are getting and what all deductions are involved in it.

US Salary Tax Calculator

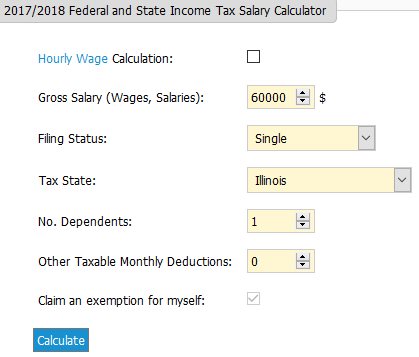

US Salary Tax Calculator is a free website which lets you calculate how much your annual income is and how much goes into your bank account after all tax deductions. When you go to the website you will first see a brief description of what all taxes you can expect to be deducted from your salary. After that when you scroll down you will find a calculator which can also be seen in the screenshot above. Enter your gross salary, filing status, tax state or state you are living in or earning wages in, number of dependents you have, any other deductions you have, check the box if you want to claim exemption for yourself. After entering all the details click the calculate button. And the results will be as shown in the screenshot below.

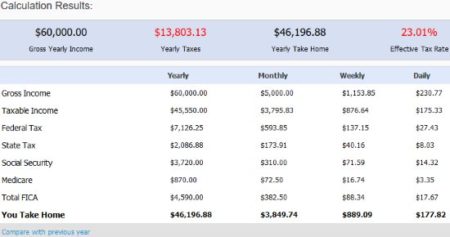

Here you can see on the top line you are shown the yearly taxes that are cut out of your gross pay and the yearly take home salary. The state tax in this calculator is calculated automatically. You just have to enter which state you live in. After that summary a detailed description of the income is given as well. Your yearly, monthly, weekly, and daily gross income is displayed first followed by taxable income, federal tax, state tax, social security, medicare, etc. After that your take home salary is displayed.

iCalculator.info

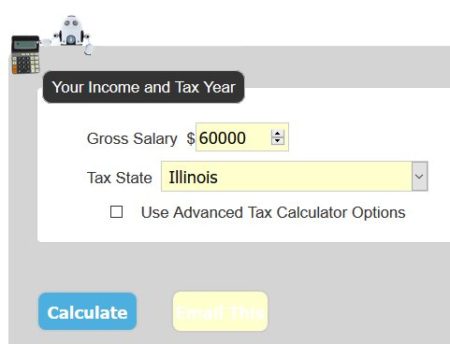

iCalculator.info is a free website which lets you calculate your salary as well as taxes deducted on it. When you land on the website you will see a calculator like the one shown in the screenshot above. Here all you have to enter is your gross salary and the state that you are living or earning your salary in. The check box for using advanced tax calculator options will open up more option for you to fill in so the salary calculations are more accurate. You will get more options like filing status, any other with holding which you would like to add, etc. This will make your salary calculations more accurate. The state taxes in this calculator are also calculated automatically. All you have to do is enter the state that you are living in in the drop box provided.

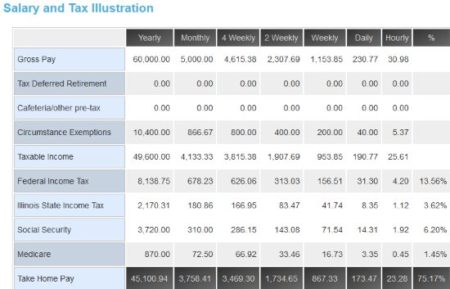

The above screenshot shows the calculations of your salary in detail. The top row shows your gross salary yearly, monthly, 4 weekly, 2 weekly, weekly, daily, and hourly. Followed by taxable income, federal income tax, state income tax, social security deducted, medicare deducted, and the last row will show your take home salary.

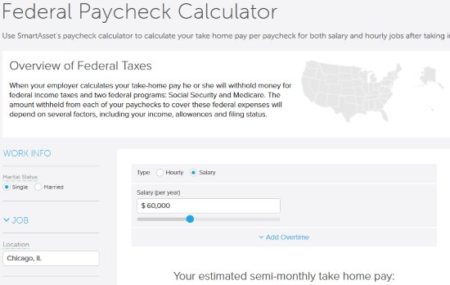

Federal Paycheck Calculator

Federal Paycheck Calculator is a free website to calculate salary and taxes on your salary. On the home page of this website you will see the calculator as shown in the screenshot above. In here mention your annual salary. On the left hand side of the page enter your filing status, your location, number of dependents, how frequently do you get paid, allowances if any, etc. State and City taxes will be calculated based on the location you enter automatically.

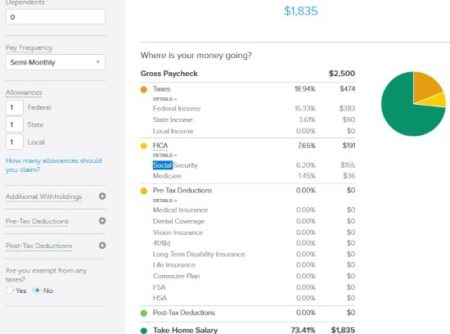

Once you have entered all the data you will get results on the same page below the calculator, as can be seen in the above screenshot. You are shown your gross pay amount followed by taxes that are deducted from your paycheck. At the bottom of the page you will see the take home salary amount.

The Salary Calculator

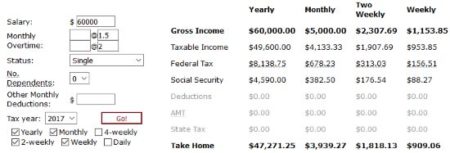

The Salary Calculator is a free website to calculate take home salary. The website is mainly for UK people but they also have a section for USA. At the top right corner of the app you will notice a small box with a button which says quick calculation. Enter your yearly income and click the quick button. This will redirect you to the page with all the calculations in it. These calculations can be seen in the screenshot above. By just entering your gross yearly salary you can get the results of your take home salary.

The calculations show you your yearly, monthly, two weekly, and weekly gross income to start with. Followed by taxable income, federal taxes, social security, etc. At the bottom it shows your take home salary. Though you will not find any state or city taxes in this calculator. This is just a basic calculator which will just calculate federal taxes.

These are the 5 free salary calculator websites with state tax calculations. You can use these and easily check out what your gross pay is and how much you are actually getting in your bank account. You will also come to know what all taxes are being deducted from your salary, and you can also find out your state taxes. So do check these websites out and see which one works best for you.