TaxSlayer offers you free tax return filing option if you qualify the criteria given on the website. This website is also a part of the IRS free file alliance. The federal return can be filed for free if you qualify, but the state returns are chargeable. You can file state taxes paying a nominal amount of money. In previous article we have covered some other tax websites which offer free tax return filing for 2019, these are, 1040.com, H&R Block, TaxAct, TurboTax, and ezTaxReturn.

Let’s start by opening the TaxSlayer website. The link for the website is given at the end of this article. The home page of the website will show you the eligibility criteria for a free return. You can file free federal tax return but the state return is chargeable excluding some states which do not have income tax and Georgia state tax return can be filed for free. Click on file for free button and you will be taken to the login page of the website.

Here you have to enter a username, password, phone number and email address to register your account. Once registered you will be redirected to the dashboard of the website. You will be asked for some personal information like name, social security number, date of birth, occupation, address, etc. Some additional information needs to be checked and then we move on to filing status.

If you know your filing status, then you can use that. Otherwise, the website has a help option on the right side of the screen, which says “filing status wizard”. Use this option to find out your filing status.

Then some additional questions need to be answered before moving on to the income section.

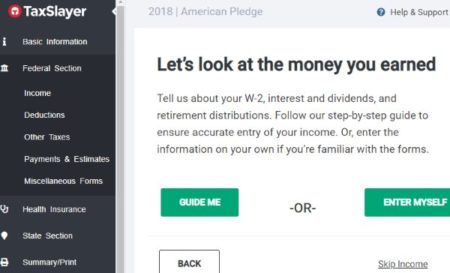

In the income section you get two options guide me, or enter myself. Let’s go with the guide me option, so that we can be sure that we do not miss out on any income.

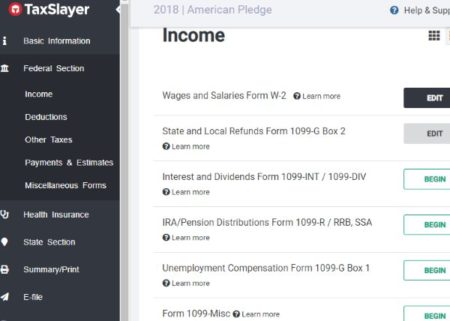

This section starts with entering your W-2 details. This includes EIN, employer name, wages, tax withheld, etc. Once done with the W-2, the income section takes you to other income categories like interest income, retirement income, dividend income, unemployment compensation, business income, etc.

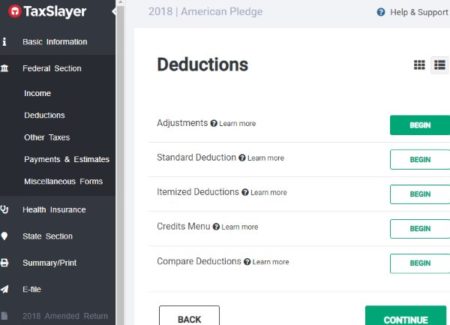

Now we come to the deductions section, so that we can cut on the taxes that we owe. Again you will get two options guide me and enter myself. Let’s go with guide me again so that we do not miss out on any deductions, just because we didn’t remember.

This section starts with deductions for family, like child care expenses, or dependent expenses. Mark as applicable to you. This section will cover earned income credit, donations, real state taxes, medical expenses, student loan interest, property taxes, moving expenses, sales tax, IRA deductions, Alimony paid, etc.

Go through some other tax situations and see if anyone of them is applicable to you. Then we come across health coverage questions. Go through them and answer accordingly.

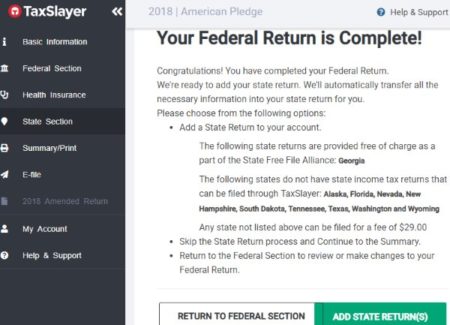

Then you will come to the federal return is complete screen. You can add a state if you have to file a state return. In this example we have selected Texas, so we do not need to fill a state tax return as Texas does not have state income tax.

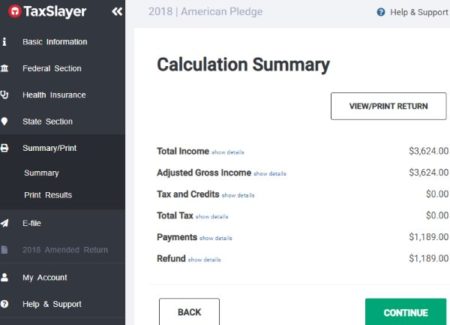

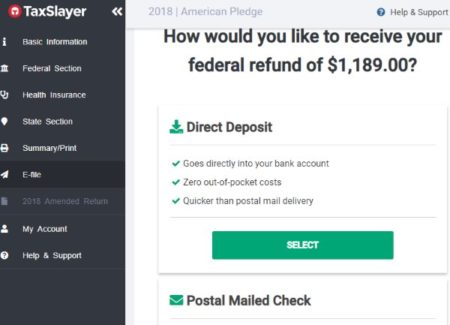

So we continue with out a state return to the summary of the return. You will be shown a summary of your return. Click continue to move on to the next screen. You will be asked to verify your email address first. After that move onto the selection on how you would like to receive your tax refund. You can choose between direct deposit and paper check which will be mailed to your address.

Review your order and answer some additional questions. Choose a 5 digit PIN number which will be used as your digital signature. Then review your personal information one more time to make sure everything is correct.

Click continue, enter the code as shown on your screen. Now click the file my return button to efile your tax return.

Conclusion:

TaxSlayer has a nice and easy to follow website for filing your taxes. The website is trustworthy as it is a part of the IRS free file alliance. The website uses simple language to ask questions and offers help when you do not understand something. Just follow the questions being asked to file your tax return this year.

Keep in mind that to be eligible for the free efile option, you need to qualify the criteria posted by the website. State tax returns cannot be filed free except Georgia state returns.

Check out TaxSlayer website here.