Online Taxes at OLT.com is another website which you can use to file your tax return online for free. As the other websites that we have covered so far, this website also has a qualifying criteria for free returns whether state or federal. The other free tax return filing websites that we have covered so far are 1040.com, H&R Block, TaxAct, TurboTax, ezTaxReturn, and TaxSlayer. OLT is also a part of the IRS free file alliance and is a trustworthy website.

With this website you can file your federal as well as state taxes online for free. The eligibility criteria for a free return is mentioned on the homepage of the website. If you qualify the conditions mentioned, then click the start now button as seen in the screenshot below.

You will be taken to the account creation page of the website. On this page you will have to provide an email address, username, password, and phone number. Add some security questions in case you forget your password. Then verify your account either using your email address or phone number.

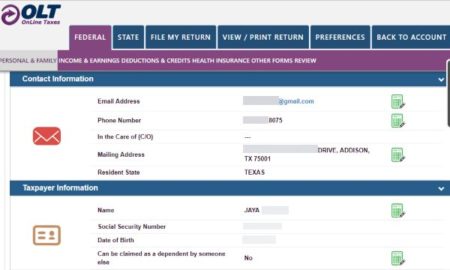

Click on the button start my return, and you will be asked to fill in some personal information like social security number, name, date of birth, occupation, etc. Then start with your return type by choosing which form to fill in. If its just a simple individual return, then choose form 1040.

Next page informs you of some tax reforms or changes that have been made to the tax law for this year. Go through them and continue. Answer some basic questions about the primary tax payer to continue. Then move on to choosing a filing status for yourself. If you know how you will be filing than choose accordingly. Otherwise, choose the guide me section given on the right side of the page to help you out. Then you will be asked some dependent questions and you will be asked to enter a valid ID. Which you can skip for now if you want. The next screen will show you a summary of your personal information filled in so far. This can also be seen in the screenshot above.

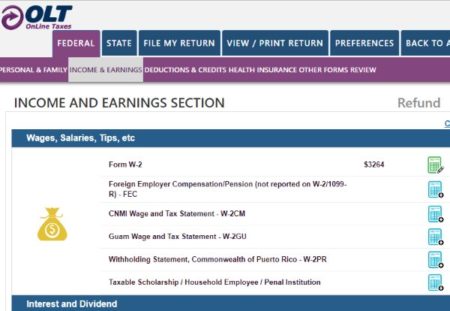

Then we move on to the income section. Under this section all the categories are mentioned list wise, which you can go through and see which ones apply to you. We will start this section with entering W-2 information. Here you are required to enter the employer name, address, EIN, wages earned, federal tax withheld, etc. The social security tax withheld and medicare tax withheld is calculated automatically according to the limits. Now click on save and continue.

Apart from W-2 this income section has categories like unemployment compensation, interest income, dividend income, business income, alimony received, distributions received from an IRA, etc. Fill in all the categories which apply to you. At the end of this section you will be shown a summary of all the income entered by you, as seen in the screenshot above.

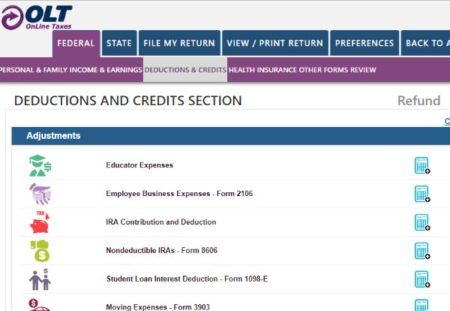

Then we move on to deductions and credits section. In this section, you can add the expenses that you had for the year like educator expenses, IRA contributions, moving expenses, alimony paid, business expenses, child care expenses, earned income credit, etc.

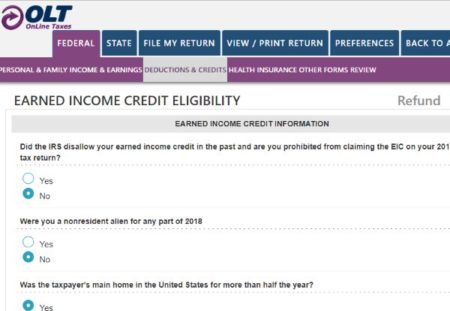

Some additional questions will be asked about the earned income credit if you choose that category, as shown in the screenshot above.

Now you will be told if your return qualifies for the free efile option through the website or not. Even if your adjusted gross income is not between $14,000 and $66,000 as specified on the website, you can still qualify for the free file option. If your income is below $14,000, you might still qualify for the free efile option on the website. So click on continue with OLT, the second last check box on this page.

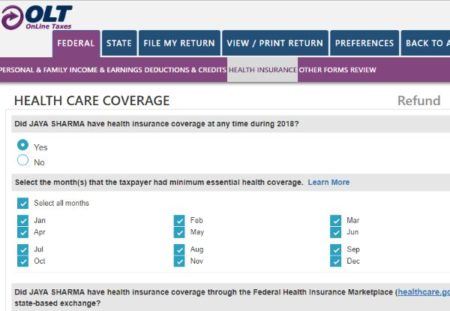

Now we move on to healthcare coverage for the year. You need to answer some questions about the kind of health coverage you had for the year, as shown in the screenshot above. Then some other tax situations will be shown to you, which you can go through to see, if they apply to you.

Click continue and you will be shown a summary of your federal tax return along with the refund amount. Click continue and you will be asked to choose a refund option. That would be how you would like to receive your refund. It can be directly deposited to your account, you can get a paper check mailed to your address, or split the refund in to multiple bank accounts. This can be seen in the screenshot below.

Now you come to your state taxes. In this example, the state selected is Texas, and as Texas has no state income tax, you do not need to fill in a state tax return. But in other cases you do need to go through the state return by answering questions as asked.

After the state return section we move on to efiling steps. You will be asked to choose a pin number which will be used as your digital signature. You will be shown a refund summary and you would see a free file invoice for your tax return.

Next screen will let you submit your return to the IRS by efiling it. So if you think your return is ready to be filed, then go ahead and click the submit button.

Conclusion:

Online Taxes by OLT.com is a good website to use if you are thinking of filing your tax return online. The website has a nice interface and the questions asked are accompanied with help in case you do not understand them. The only thing missing is a step by step guide, when it comes to income, deductions, and credits section. The website shows them as a list of categories which you can choose from. It would be easier if it took the individual through each category, to make sure they don’t miss out on something.

Check Online Taxes at OLT.com website here.