There are hundreds of services to get daily updates of the stock market and lots of them also let you set your preferences. You can get stock updates by emails, check stock websites, and use mobile apps to track market stocks on the go. There are also stock screeners where you can filter the latest stocks as per your preference. You can check out 10 online stock screener websites here.

But, almost all of these stock screens give you only the market data. They fetch the stock updates from the stock market and deliver that to you. And, as you might be aware of, stocks do not solely depend on the market. There are many other factors that can have a big impact on the stocks. And, that’s where the stock market researchers and experts come into play. They study many internal and external factors that can affect the stocks. It includes market history research, market trends, current market state, social sentiments, and so on. In this article, I will cover a free stock update service that does all that but uses the latest technological computations instead of researchers and experts.

Get Free Daily Stock Updates Powered By Social Sentiments, AI, Neural Networks:

Signals.me is a free stock & Forex signal service that gives you daily stock updates powered by social sentiments, artificial intelligence, and neural networks. This service deep analyzes all the major factors that can affect the stock market and picks the stocks and arranges them in a certain order. Then, it gives you “Buy/Sell” signals for all those stocks.

The top three major factors to predict the stocks are social sentiments, the current market state, and historical trends. Signals.me targets these factors using advanced technologies such as machine learning, artificial intelligence, and neural networks.

How Signals.me uses these technologies to predict the stock market?

Social Sentiments

Social sentiments include what people think about a company, what the media is saying, and what other experts’ and social influencers’ point of view about the company or situation. And, generally, all this can have a major effect on a company’s stocks. For example, if you are following the financial news or arguably the most influential person of the decade, Elon Musk, you might hear about the financial issues he’s having with his energy company Tesla. There is lots of bad press around the company which affected the company’s stock many times. Sometimes, Elon’s own actions also led to affect the stocks. And, due to all this social sentiment and its effects, he seriously thought about taking the company private. So, social sentiments can have a big impact on a company and its future.

Signals.me uses cloud computing for social sentiment analysis. It processes data from various online platforms to track ongoing trends, what people are talking about, and studies the consumer base. Based on its social sentiment analysis, Signals.me predicts the outcomes of these social sentiments.

Artificial Intelligence

The second main factor to predict the stocks is the current market state like how a company is performing, what is its growth rate, does it have consistent profits/losses, and so on. Signals.me uses artificial intelligence to study and deep analyze all these market-related factors.

Neural Networks

The third factor to predict the stocks is historical trends. Signals.me used neural networks to adapt to historical trends. It keeps the track of past market trends, companies performance history, etc. and uses all that information for predictions.

With all these technologies, here are the things that Signals.me offers to its users:

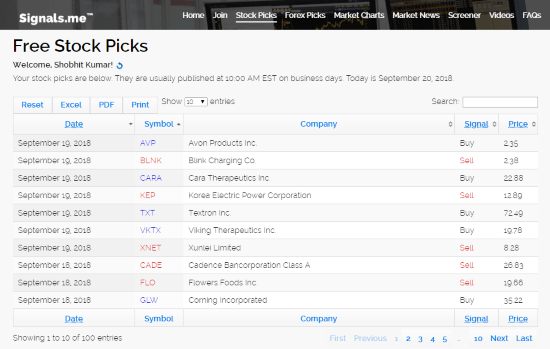

Stock & Forex Picks

Based on all its study and research, Signals.me gives you lists of stock picks and Forex picks. In these lists, it shows you the companies stock prices on the current date. Both these lists have a “Signal” column where Signals.me suggests whether you should buy or sell a company’s stocks. These Signals are the predictions based on computational search and analysis. You can save these lists as Excel sheets or PDFs, or print them directly.

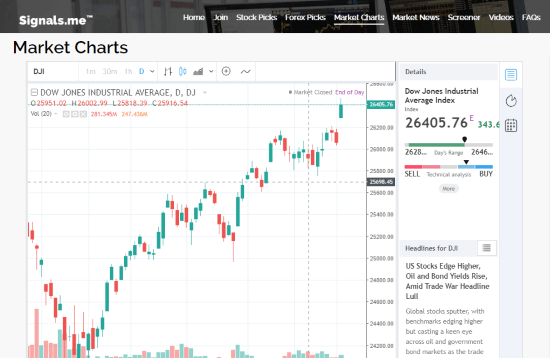

Market Charts

If you want to deep analyze a company yourself, Signals.me provides advanced market charts for that. With the help of market charts, you can track a company’s market history, performance, trends, gain, loss, etc. You can see all this data in Bars, Candles, Hollow Candles, Heikin Ashi, Line, Area, and Baseline representations. You can also compare multiple companies as well.

Right to the market chart, you get three more options:

- Widgets: Shows you a company’s current market details and provides technical analysis summary.

- Hotlists: Shows you a list of companies with significant % changes.

- Calendar: Shows you the economy and earnings calendar.

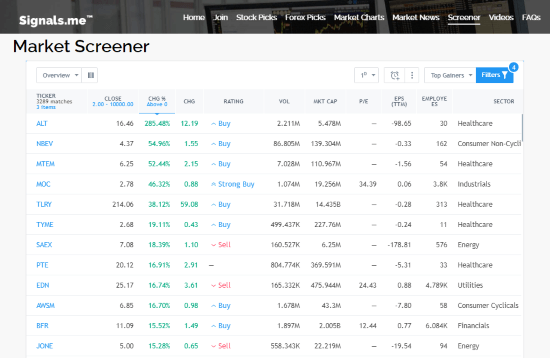

Market Screener

Signals.me also has a Market Screener where you can filter the stocks based on your own metrics. With this screener, you can track the Overview, Performance, Valuation, Dividends, Margins, Income Statement, Balance Sheet, Oscillators, and Trend-Following. For all these screens, you can customize and re-arrange the columns, and add filters to them as well. You can also change the update interval and set update alerts.

Get daily stock & regex updates here.

Wrap Up:

Signals.me is an appreciable service that uses the computation and latest technologies to predict the stock market. All these technologies have great potential that can be really helpful in the financial sector. But, at the end of the day, these are just predictions based on computational studies and research. They might not always be correct, but its good to have one more source to consider especially in the stock market.