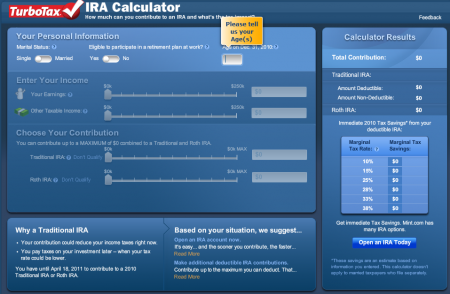

IRA Free Tax Calculator is a free IRA tax calculation tool by TurboTax to estimate how to make best use of your IRA contributions and how much you can deduct on your taxes from your IRA.

When you go to this free tool you would need to enter some basic information like your filing status, age, earned income, whether you or your spouse (if married filing joint) participate in a retirement plan at work. After you provide this information, you would need to enter your IRA contribution amount. This could be the amount you actually paid in or the amount you would like to contribute for the current year.

Then on you right hand side you would see a box titled calculator results. This box will show you how much of the amount you contributed to the IRA is deductible on your taxes. You might be able to deduct everything or part of your contributions. You can also get more information on IRA’s like whether to invest in a Traditional IRA or Roth IRA.

Also read: File state tax return free.

The tool has a very simple and user friendly interface. It comes from the makers of TurboTax Free. Plus it will also give you great advice for making further contributions. Like if you want to open and contribute to an IRA account, you still have time to include these contributions on your 2010 taxes. You have till 18th April to make contributions to a Traditional or Roth IRA account for 2010.

Try IRA Tax Calculator free here.